Jumia has released its financial report for the fourth quarter of 2019. The Africa-focused ecommerce platform started the year 2019 on a high with its listing on the New York Stock Exchange. But things went downhill after that, and it endured a difficult period for the remainder of the year.

In late 2019, Jumia started a sort of re-organisation. It shut down ecommerce operations in three countries and spun off operational roles in Jumia Travel.

So Q4 2019 report should capture the company’s growth and path to profitability.

Jumia’s Full Year GMV Crosses $1 billion

For the first time, Jumia’s gross merchandise value (GMV) crossed $1 billion. Its 2019 GMV was $1.19 billion, up from $898.6 million recorded in 2018. While this is a notable growth, there’s a catch. But first a throwback.

In May 2019, only weeks after Jumia’s IPO, Citron Research published a report claiming fraudulent practices by Jumia. The US company said Jumia’s method of reporting GMV was suspicious and accused the company of having high rates of cancelled and returned orders. The damning report took a swing at the retailer’s share price, knocking it down and crashing its billion-dollar valuation.

Jumia dismissed the report but carried out an investigation of its own. In its third quarterly report, the company identified staff and independent sales consultants who were engaged in fraudulent transactions.

In its fourth quarter report, Jumia said the investigation is now completed. It identified “improper orders, mostly placed in the second quarter of 2019” and “ have also implemented measures designed to prevent similar conduct in the future,” the company wrote.

Between October and December 2019, the retailer said it recorded GMV of $327 million. However, the company added a curious detail:

“Adjusting for perimeter changes as a result of the portfolio optimization undertaken during the quarter, as well as previously reported improper sales practices, GMV of the fourth quarter of 2019 would have been €293 million, up 6% from €275 million in the fourth quarter of 2018.”

This raises a number of questions, like why is Jumia reporting a higher figure it knows is flawed by “improper sales practices”? Why not put out the adjusted figure instead?

That’s something to ponder on.

Losses soared in 2019

Revenue for the retailer slowed in the fourth quarter relative to earlier periods. During this period, the company posted revenue of $53.7 million, while its full 2019 revenue grew to $174.66 million up from $140.52 million in 2018.

What about its losses? They are up; way up!

In Q4, the company lost $69.2 million. And for the full year, Jumia lost $247.95 million, a 34% increase over the previous year.

However, a notable chunk of its losses is attributed to share-based compensation (SBC) related to its successful IPO. Jumia paid over $40 million as SBC in 2019.

Regardless, the retailer has now accumulated over $1.2 billion in losses since 2012.

6.1 million total customers

Jumia added 500,000 new customers between October and December 2019. The retailer defines an annual active customer as “unique consumers who placed an order for a product or a service on our platform within the 12-month period preceding the relevant date irrespective of cancellations or returns.”

It now boasts 6.1 million customers who made 26.5 million orders.

What’s the progress report on JumiaPay?

In 2018, Jumia launched JumiaPay, a payment processor for transactions on its platform. One year later, the service has grown quickly to become an important pivot for the company.

Between October and December, JumiaPay processed 2.4 million transactions with a total transaction volume of $49.6 million. In perspective, the service processed 2.1 million worth $35.3 million.

The plan with JumiaPay is to leverage the retailer’s marketplace to create payment giant similar to how Alipay became a colossus because of the Alibaba marketplace.

According to Jumia’s co-CEO, Jeremy Hodara, “our job is to make sure that because we have this huge marketplace ecosystem because we have a great product; because we have this base of consumers, we want to make sure JumiaPay is in a position to become the next Alipay, the next PayPal.”

The retailer wants to open up its payments arm to non-Jumia services and businesses.

However, at the moment, JumiaPay is no PayPal. It has a long way to go and needs the ecommerce platform to keep growing.

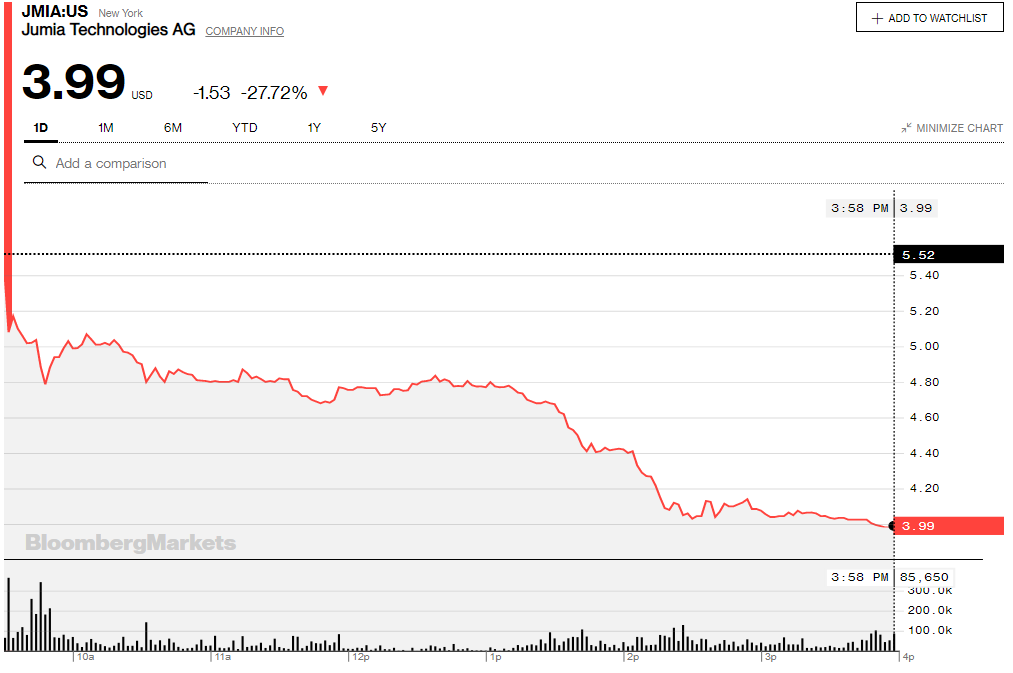

How is the market reacting?

Wall Street isn’t thrilled by Jumia’s Q4 performance or its path to profitability.

Jumia’s share price has crashed to $3.99; a 27.72% slide, and its lowest since it listed on the stock market last year. The retailer needs a serious turnaround. Unfortunately, it can’t pull that off on its own without significant economic growth in its operating markets.

Source: TechCabal